For years, participation in employer-sponsored retirement plans has been encouraged and promoted. You have the opportunity to make tax-advantaged contributions toward your retirement, and your employer wants to help make it as seamless and straight-forward as possible for you to achieve your financial goals.

Take Advantage of Employer Incentives

Sometimes we need a little additional encouragement to begin participating in our retirement plan option, so employers may offer additional incentives. Check with your human resources representative to see if your employer has a matching or profit sharing component that may provide additional contributions toward your retirement. The retirement plan has been designed with you in mind, so take advantage of all it has to offer.

Tax Benefits of Retirement Savings

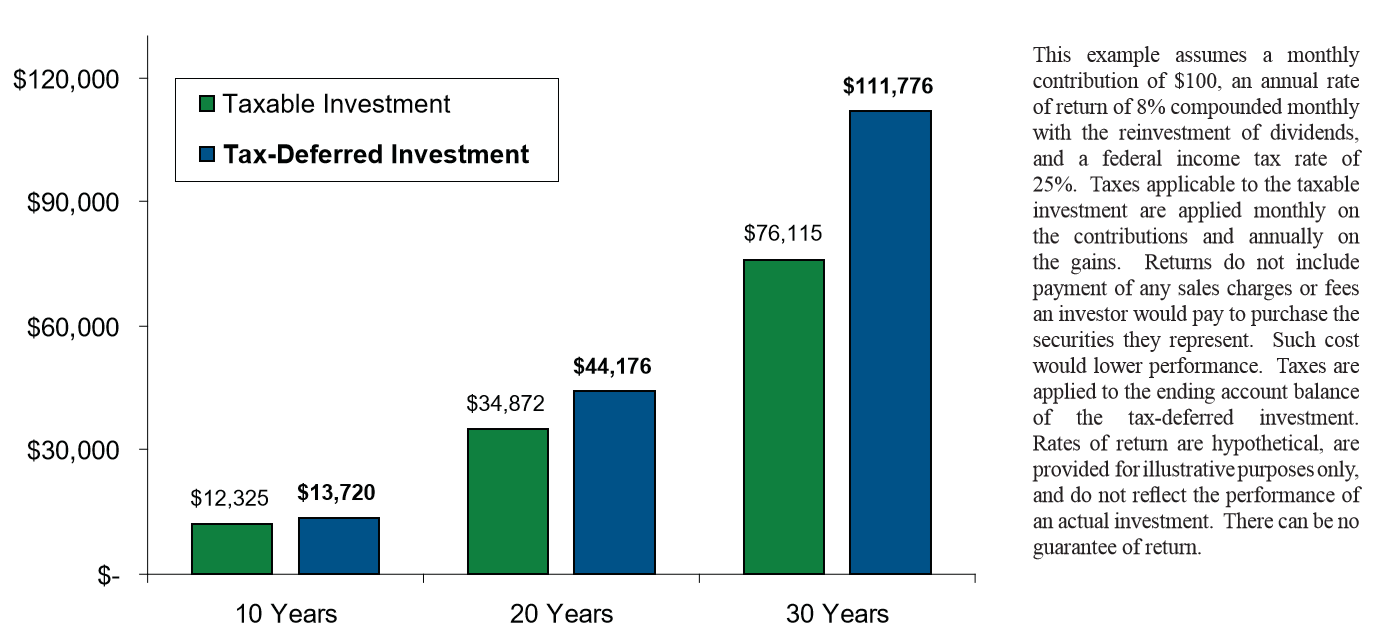

By saving in your 401(k) plan on a pre-tax basis, your gross income is reduced by the amount you contribute, thus lowering your current taxable income. Including contributions and earnings, your account will accumulate tax-deferred; in other words you will not owe taxes on the account until distribution. This compounding of tax-deferred contributions and earnings gives your account the opportunity to grow over time. Historically, the tax rate has gone down at retirement for most individuals, because they will have less earned income. Therefore, you are taking distributions at a lower tax rate and potentially creating a greater benefit for yourself. Please consult your tax advisor regarding your specific legal or tax situation as needed.

Meet Your Goals and Objectives

Since their inception, retirement plans have been implemented in the workplace to minimize the burdens associated with saving for retirement. You have big goals and big dreams, and we're here to help you take the steps toward achieving those goals. The hardest part of making the commitment is simply to start. Don't get overwhelmed - envision your retirement, set your financial goals, discuss your plan of action and get started. Remember, we will be there along the way.

We are Here to Help

EIP is committed to offering the assistance you need to help you achieve your retirement goals. We specialize in breaking down the complexities of saving in the most efficient manner to bring your retirement into focus. Let us help you start and continue saving for a more enjoyable retirement.