Retirement Plan Services

IN-HOUSE & BUNDLED RETIREMENT PLAN SERVICES FOR MAXIMUM EFFICIENCY

Plan Services

EIP services ALL your 401(k)

& retirement plan needs

EIP offers a unique bundled service that allows us to handle all your retirement & 401(k) plan needs from one place. Our commitment to provide our clients the best business retirement plan consulting, administration, recordkeeping & fiduciary support is shown by our team's extensive credentials, experience, technology & our firm's long history. From 401(k) plans to ESOPs, we've seen it all & are well equipped to manage your retirement plan.

SIMPLE.BUNDLED.AFFORDABLE

LEARN HOW EIP's RETIREMENT PLAN SERVICES CAN HELP YOU

LEARN HOW EIP's RETIREMENT PLAN SERVICES CAN HELP YOU

KEEPING YOUR 401(k) & RETIREMENT PLAN IN COMPLIANCE

Third Party Administration (TPA)

-

Establishing plan and trust documents

-

Managing & amending plan documents

-

Participant statements

-

Processing terminations, loans & hardship distributions

-

Reviewing eligibility

-

Reconciling plan assets

-

Preparing & filing annual returns with the IRS.

-

Non-discrimination testing (ADP/ACP test)

-

Employee notifications

WE ENSURE ALL 401(k) & RETIREMENT PLAN OBLIGATIONS ARE MET

Recordkeeping & Plan Reporting

Plan reporting and recordkeeping tends to overwhelm plan sponsors by creating unnecessary pressure and disruption. Let our firm take on the responsibility of not only preparing the necessary filing reports, notifications and statements, but also keeping track of all plan contributions, withdrawals and individual participant account balances. We streamline the entire recordkeeping process with our EIP Exchange Platform, resulting in fewer errors and less overall cost. Our technology, scale and expertise are designed to meet all your plan obligations so that you can rest assured that all of your plan's obligations are being met.

EXPERTS IN ERISA LAW, 401(k) PLANS & RETIREMENT PLAN DESIGN

Retirement & 401(k) Plan Design

At our core, our in-depth ERISA knowledge & our decades' worth of experience designing custom retirement plans to meet our clients' needs is what sets EIP apart from the rest. No cut-and-paste plans - instead we work with you to tailor & design a retirement plan specifically to accomplish your goals & business objectives.

-

401(k) Profit Sharing Plans

-

Safe Harbor 401(k) Plans

-

Profit Sharing Plans

-

Defined Contribution Plans

-

Defined Benefit Plans

-

Plus many more options

WE HELP SHOULDER PLAN SPONSOR FIDUCIARY RESPONSIBILITY

3(38) Investment Manager - Fiduciary

The regulatory landscape has dramatically changed in recent years, and fiduciary liability has become an increasingly burdensome responsibility for plan sponsors. To help manage this liability we serve as your ERISA 3(38) Investment Manager. This effectively creates a co-fiduciary relationship between you, your plan and us.

-

A 3(38) selects & takes on the liability for selecting the plan investment lineup

-

A 3(38) monitors & takes on the liability for monitoring the plan investment lineup

-

A 3(38) takes on the liability for replacing & updating the plan investment lineup

-

Plan Sponsors get a layer of liability protection by shifting investment decisions

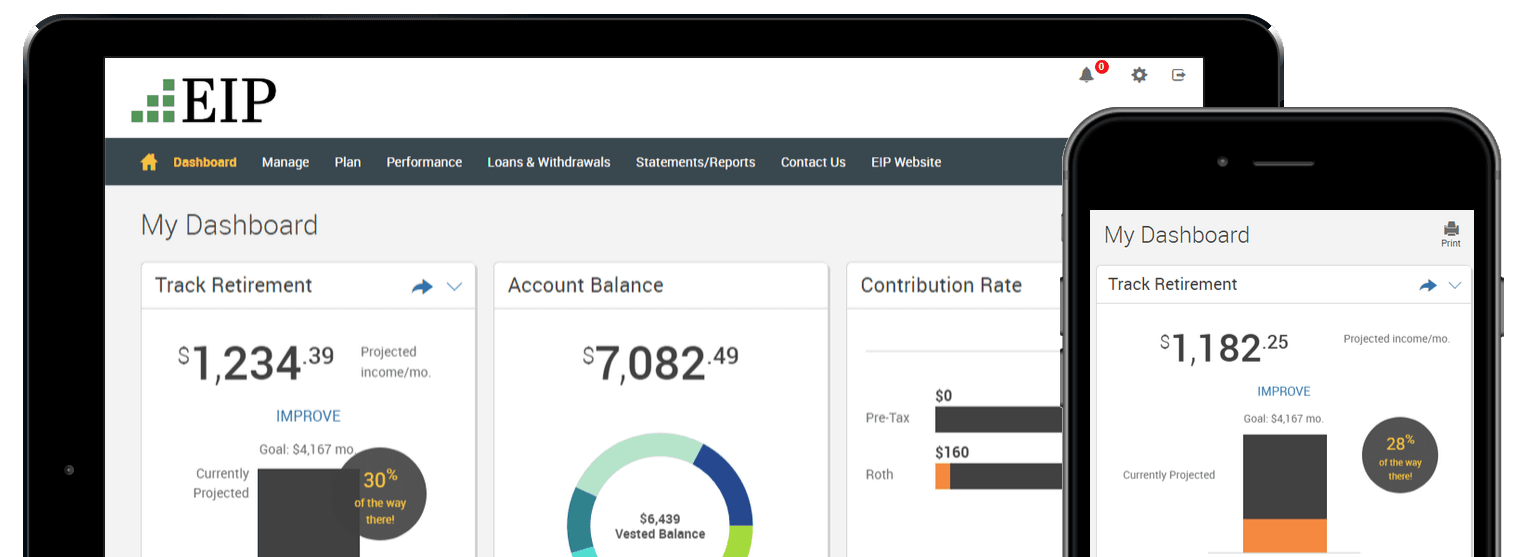

MANAGING YOUR RETIREMENT ACCOUNT IS SIMPLE WITH EIP'S TECHNOLOGY

EIP Exchange - Participant Portal

No longer do participants need to sort through complicated account statements to simply determine how their 401(k) account is performing. Through EIP Exchange, all participants have immediate access to their retirement account. Our trading and custodial platform allows participants to manage all aspects of their retirement plan at any time of the day.

-

Check account balance

-

Execute trades

-

Intuitive dashboard

-

Investment performance

-

Rebalance portfolio

-

Plus much more

STREAMLINE NEW EMPLOYEE 401(k) ENROLLMENT PROCESS

Online Enrollment - New Employees

EIP makes paper enrollment a thing of the past with our online enrollment platform. New participants can enroll in their 401(k) profit sharing plan at any time. Plan sponsors & participants get instant confirmation emails, and a copy of the enrollment form is saved into our clients' FTP ShareFile folder for easy access & review.

-

24/7 enrollment

-

User-friendly

-

Customized enrollment

-

Review plan benefits

-

Review plan features

-

Enrollment video

-

Confirmation emails

-

Plan disclosures

-

Plus much more

HIGH QUALITY, LOW COST INDEX & MUTUAL FUNDS

Low Cost 401(k) Investment Options

EIP is structured to serve all participants' investment needs, despite the wide range of financial situations, retirement goals and investment knowledge that may differ from one plan participant to the next. With our independence and Fidelity as our custodian, and our open architecture platform offers industry leading low-cost, high-quality investment options that much of our competition cannot offer.

-

Vanguard Funds

-

Fidelity Funds

-

American Funds

-

DFA Funds

-

PIMCO Funds

-

And many others

EDUCATION BRINGS YOUR 401(k) & RETIREMENT PLAN FULL CIRCLE

Educational & Enrollment Meetings

Although retirement plans provide enormous benefits to employees, employers struggle communicating the value due to the exhaustive complexities involved. This is why EIP goes beyond most retirement plan providers by visiting your offices to hold new 401(k) enrollment meetings and ongoing retirement seminars. We educate, communicate and help your employees understand the importance of saving for retirement.

FOR PROSPECTIVE CLIENTS

Contact EIP & Have EIP Help You Today