Employee Incentive Plans, Inc (EIP) will assist you in developing a plan best suited for your organization. To do so, we will complete a thorough analysis of various factors such as workforce demographics, business and individual tax planning, funding considerations, administrative requirements and much more. The analysis provides us with a blueprint to design a retirement plan that maximizes benefits and best meets the specific needs of your organization. Plan design considerations generally involve - employee eligibility, pre-tax and roth, automatic election, employer funding, vesting, distribution options and more.

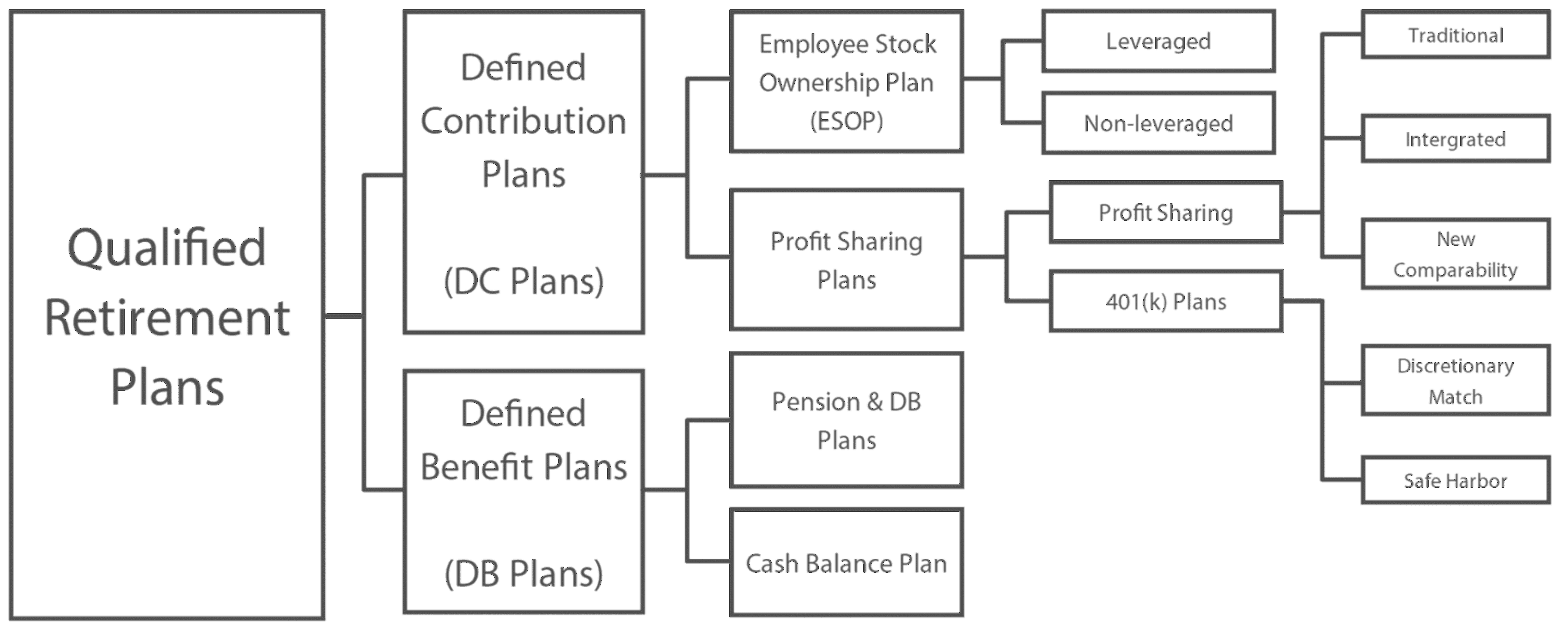

Qualified Retirement Plans

Design a retirement plan to meet your business objectives

Selecting The Right Retirement Plan

Profit Sharing Plans

Profit sharing plans allow for the sharing of employer profits with employees utilizing the discretionary option. Since neither the contribution nor the benefit is fixed, some employers find this desirable if they are not certain how much they can contribute to a plan from year to year. The maximum contribution for the firm is based upon the maximum deduction limits of 25% of eligible compensation with limits on contribution allocations per participant. This plan generally favors younger employees and is utilized by businesses requiring flexible contribution levels.

401(k) Savings Plans

These plans fall under profit sharing plan rules and allow employees to defer a portion of their salary into a 401(k) retirement plan. These contributions are traditionally made on a pre-tax basis, though an after-tax option may be available. The maximum annual deferral amount is periodically indexed by the government for cost of living adjustments (in 2020 the limit was $19,500 / $26,000 for above age 50). Employers may choose to offer a matching contribution based on the amount an employee defers, and additionally may extend a discretionary profit sharing contribution. Non-discrimination rules apply to annual deferrals and matching contributions. This type of plan is designed to involve employees in saving for their retirement and enables their funds to accumulate at an accelerated rate.

Safe Harbor 401(k) Plans

Recent regulations have simplified nondiscrimination testing while improving contribution levels for your highly compensated employees (HCE). The general rules of using a safe harbor plan are:

- Maximum 401(k) contributions are allowed for HCE without regard to deferrals by non-HCE. The safe harbor plan eliminates ADP and ACP testing when the plan satisfies the applicable safe harbor requirements.

- Satisfaction of the ADP and ACP test requires an approved safe harbor employer non-elective contribution (profit sharing) or matching contribution.

- Timely notification of a safe harbor plan to eligible employees is mandatory for each year the employer will apply the safe harbor rules. The notice must be provided at least 30 days before the beginning of the plan year.

- The plan document must specify the provisions the employer elects as safe harbor options to satisfy the ADP and ACP test

- The safe harbor contribution may allow a free pass on ADP testing, ACP testing and top heavy requirements if no additional contributions are made to the plan. Additional contributions are allowed but may require testing or certain allocation requirements.

- The safe harbor contributions may be contributed to non-HCE only or may include HCE. If including HCE, the benefit becomes greater to HCE.

- The basic matching formula is 100% of the employee's elective deferrals up to 3% of compensation and 50% of the next 2% of compensation, up to a maximum of 5% of compensation. For example, if a participant has elective deferrals of 5%, the matching contribution will be 4% of the employee's compensation.

- The employer has the option of using an Enhanced Matching Formula that is stated in the plan document. The most common is 100% of the employee's elective deferrals not exceeding 6% of compensation. We will discuss the enhanced formula in detail with any employer wanting to contribute more than the basic match level.

- The employer also has the option of contributing a non-elective contribution equal to 3 percent of compensation to eligible employees instead of a safe harbor matching formula.

- Safe harbor contributions must be 100% vested and are subject to the same distribution rules as 401(k) contributions.

Defined Benefit Plans

Defined benefit plans have a fixed benefit that is determined by an employee's salary history, years of services and age. Contributions are actuarially determined and are calculated based on the funding that will be needed to provide the benefit for each eligible employee at retirement. The maximum allowable benefit per employee is 100% of compensation, as long as this falls within maximum limits set by the IRS. This maximum amount is indexed each year for cost of living adjustments. This plan is not flexible as to the funding requirements and is generally more expensive to administer and maintain due to the IRS and actuarial requirements. This type of plan generally favors older, higher paid employees and is for employers looking for greater deduction limits.

"Cross Tested" Defined Contribution Plans

Cross testing rules permit a defined contribution plan to be considered nondiscriminatory on the basis of the benefits that will be provided, rather than how employer contributions are allocated. These types of plan allocations are skewed to favor highly compensated employees. The allocation method for these plans will vary each year depending on the level of contribution and the census data. The plans are subject to complicated non-discrimination testing of Code Section 401(a)(4) and are generally more costly to the employer.

Money Purchase Pension Plans

In a money purchase plan, the employer's annual contribution is defined by a formula in the plan document and is not discretionary. The annual contribution limit for any participant can be set at any contribution percentage not to exceed 25% of his or her total compensation, with annual limitations per participant. Employee contributions are not permitted. This plan generally favors younger participants and is not considered to be as flexible as profit sharing plans.

Employee Stock Ownership Plans (ESOPs)

An employee stock ownership plan (ESOP) is a qualified plan that invests primarily in qualifying employer securities. ESOPs allow employees to become stockholders in the company through employer contributions of the company's stock. Employers choose this plan when they want to give an incentive to employees by rewarding them with ownership in the company. The regulations that monitor these plans are complex and incorporate many profit sharing rules.

FOR PROSPECTIVE CLIENTS

Learn Which Plan is Right For Your Business