Within your retirement plan, EIP offers professionally managed portfolios that you can choose from. Because the numerous investment options, you may feel unprepared or uncomfortable managing your own investments. Our advisory services provide a simplified process that allows you to choose a portfolio within your plan based upon your risk tolerance or age, which will automatically create a diversified portfolio on your behalf.

BRIDGE PORTFOLIOS

Powerful Investment Solution For Long Term Success

INVESTING WITHIN A BRIDGE PORTFOLIO

Investing in a Bridge Portfolio is simple. Portfolios are created by using a risk tolerance score or by a participants age. We will automatically update & monitor the Bridge Portfolio on the behalf of the participants invested in them.

Create long term success with a

diversified portfolio

Why a Bridge Portfolio may be right for you

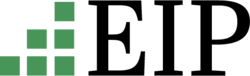

Studies have routinely shown average investors lack the discipline, objectivity, expertise and patience to effectively and efficiently manage their retirement portfolios. As markets go through their customary ups and downs, investor psychology begins to compromise their long-term objective of accumulating retirement assets. These market cycles tend to create emotions ranging from euphoria to complete panic. These emotional highs and lows have historically contributed to a substantial under-performance relative to a broad-market stock index.

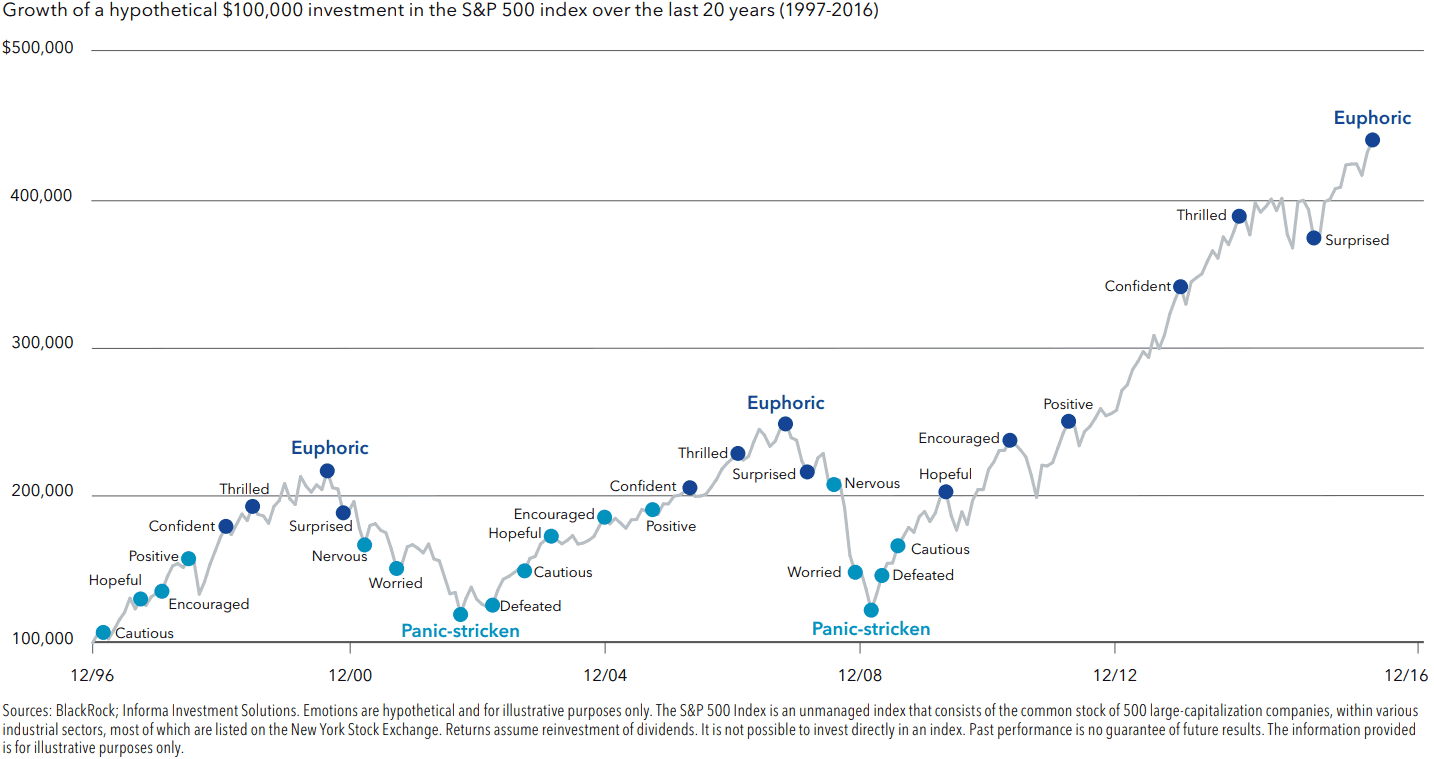

The graph illustrates how the average investor performed between 199 to 2016. You will notice that average investors returned significantly less compared to other market indicators.

Our managed portfolios help to minimize common investment mistakes and provides the support that many participants need to accomplish their long term retirement goals.

Avg. Investor = 2.29% vs Stocks = 7.68%

Which Bridge Portfolio is best for you?

Age-based Bridge Portfolio

Participants who enroll online are automatically recommended to invest in a Bridge portfolio that matches risk characteristics of someone their age. Our system will then automatically move them from one model to the next as they age.

Risk-based Bridge Portfolio

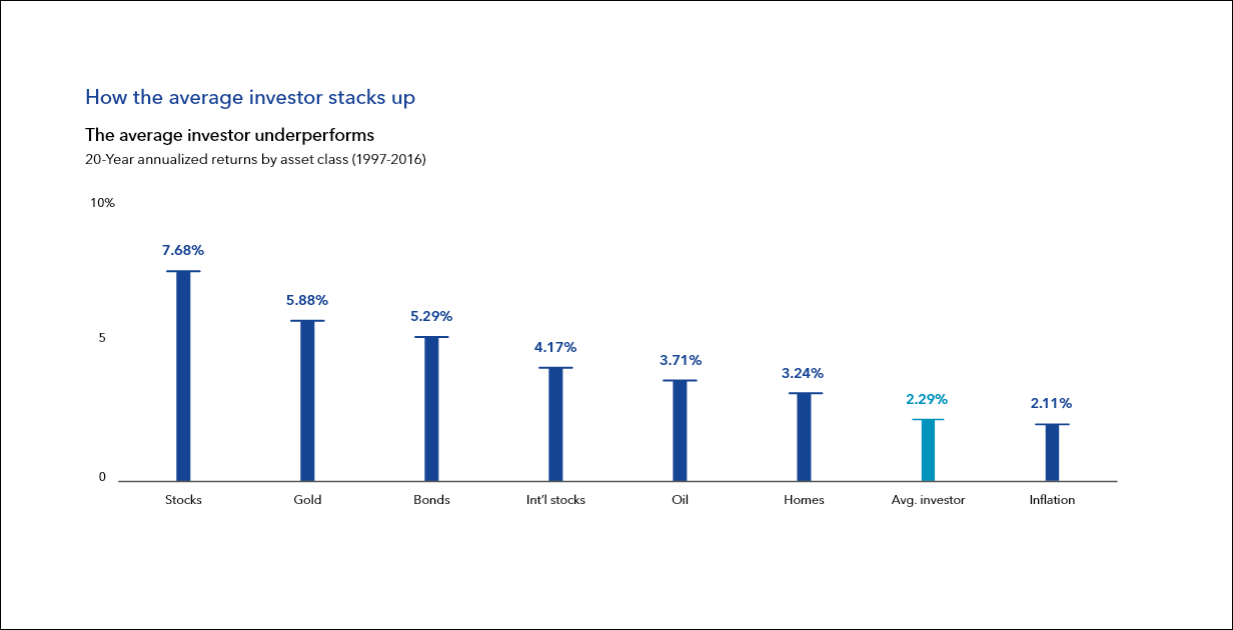

Participants that are unsure how much risk they can handle will be able to take a five question risk questionnaire. Depending upon those answers, the online enrollment system will recommend one of seven Bridge Portfolios that meets those risk characteristics.

Self-directed Bridge Portfolio

Participants that want more or less risk are able to override the recommended age-based Bridge Portfolio. They can review the risk characteristics of each Bridge Portfolio and select the one they believe fits their investments needs.

Additional Information on Portfolios

Bridge Portfolio One Summary

Bridge One portfolio is an aggressive investment strategy suitable for those who desire to emphasize capital appreciation while accepting a higher level of risk and volatility. It is typical for individuals under age thirty to invest in Bridge One. The portfolio is predominately comprised of equity mutual fund investments - both domestic and international - with a small percentage of the portfolio allocated to fixed income mutual fund investments. Typical financial situation is (1) comfortable with investment and market volatility (2) no foreseeable withdraws.

Time Horizon

± 35 years till retirement

Typical Age Group

Under age 30

Risk Tolerance

Aggressive

Asset Allocation

± 90% equities / 10% fixed income

Investment Strategy

Growth

Bridge Portfolio Two Summary

Bridge Two portfolio is an investment strategy suitable for those who desire a high degree of capital appreciation by means of equity mutual funds - both domestic and international. It is typical for individuals between the ages of 30-39 to invest in Bridge Two. A high degree of volatility is still expected despite an increase in fixed income investments from Bridge One.Typical financial situation includes (1) low likelihood of withdrawal (2) growing account balance (3) stable employment income.

Time Horizon

± 30 years till retirement

Typical Age Group

Age 30 to 39

Risk Tolerance

Moderately Aggressive

Asset Allocation

± 80% equities / 20% fixed income

Investment Strategy

Growth & Income

Bridge Portfolio Three Summary

Bridge Three portfolio is an investment strategy suitable for those who desire a balance between investments aimed at achieving capital appreciation and those seeking income. It is typical for individuals between the ages of 40 to 49 to invest in Bridge Three. The portfolio is comprised of approximately 70% equity mutual fund investments and 30% fixed income mutual funds. Typical financial situation includes (1) steady employment (2) emergency fund established (3) paying off outstanding debt.

Time Horizon

± 25 years till retirement

Typical Age Group

Age 40 to 49

Risk Tolerance

Moderate

Asset Allocation

± 70% equities / 30% fixed income

Investment Strategy

Balanced

Bridge Portfolio Four Summary

Bridge Four portfolio is an investment strategy suitable for those who desire long-term growth through capital appreciation along with a substantial investment in fixed income mutual fund investments to help decrease the level of volatility. It is typical for individuals between the ages of 50 to 59 to invest in Bridge Four. The portfolio is predominately allocated to fixed income investments, although a high percentage of equity mutual funds remain. Typical financial situation includes (1) rising retirement account balance (2) low debt (3) maximum contribution rate.

Time Horizon

± 15 years till retirement

Typical Age Group

Age 50 to 59

Risk Tolerance

Moderately Conservative

Asset Allocation

± 60% equities / 40% fixed income

Investment Strategy

Equity-Income

Bridge Portfolio Five Summary

Bridge Five portfolio is an investment strategy suitable for those who desire current income with a small potential for growth from capital appreciation. It is typical for individuals age 60 or older to invest in Bridge Five. Since the primary concern is current income, the allocation to fixed income mutual fund investments is emphasized. Typical financial situation includes(1) increased likelihood of withdrawal (2) large retirement savings.

Time Horizon

± 10 years till retirement

Typical Age Group

Age 60 and Older

Risk Tolerance

Conservative

Asset Allocation

± 50% equities / 50% fixed income

Investment Strategy

Income